Choosing A Yield Generating App

Steer Finance intends for a diverse array of ways by which users can control their assets in a decentralized space. From apps providing liquidity via Uniswap v3, to trading based on price, to staking coins, it can be difficult to discern which are quality funds that are right for you to increase your ‘return-on-investment’ (ROI) and most importantly not lose it! With this guide, the aim is to increase awareness about different yeild generating apps so potential liquidity providers can be informed of the risk they would be taking by investing in a specific strategy.

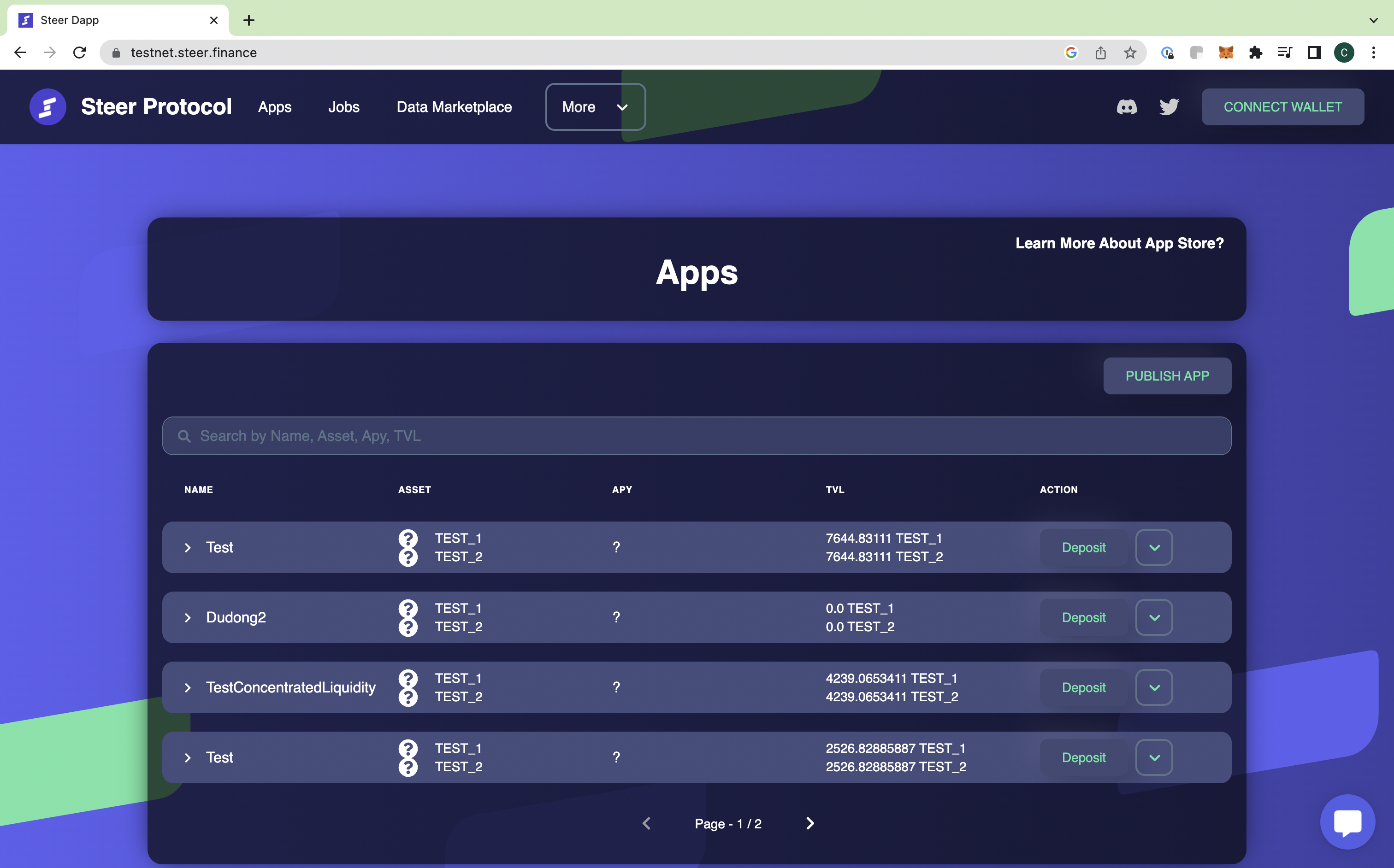

You’ll find in the image below the ‘Apps’ page on the Steer dApp. When the protocol goes live, this table will show a list of all apps available to be invested in or used. Some of these are steer featured apps, but those with the technical skill can also publish apps. Users will also have the opportunity to build on top of existing apps as well. To start with we have build a uniswap v3 engine on which yield generation apps can be built.

Analyzing Risk v. Reward

Notice a column in the center of the table listed “APY.” For testnet we recommand the user to use our backtesting toolkit but for mainnet the number shown here represents the ‘Annual Percentage Yield’ estimated for each associated yield strategy as run by the parameters governing it. Though only currently viable for Uniswap v3, our backtesting toolkit is a good way for interested parties to try a strategy by simulating different market conditions to gain insight into how well it performs. Risk is an inherent part of investing and typically the higher the risk, the higher the potential reward. You will also notice which tokens are supported by each strategy so you can choose a compatible one for the assets you wish to invest. As you can see, when launched it will be very intuitive for a user to find an optimal strategy for their investment desires.

Use our backtesting toolkit to learn more about it.