Classic Rebalance Strategy

Basic Overview

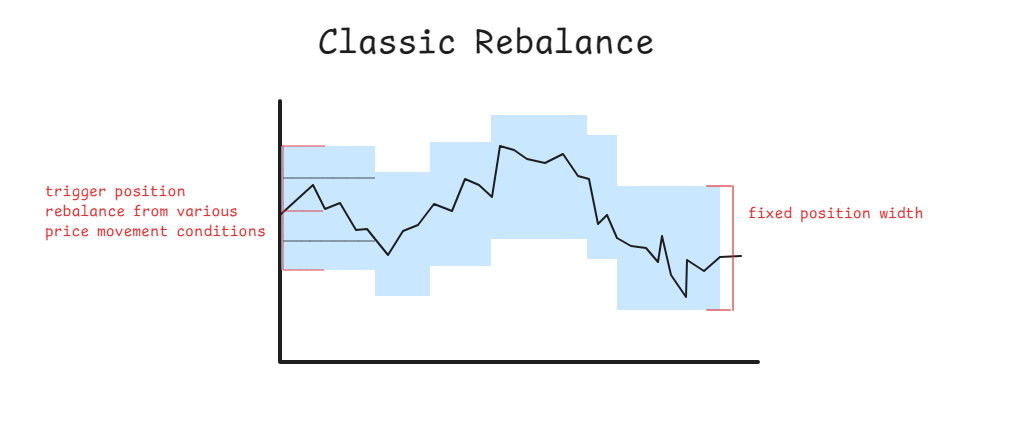

The Classic Rebalance Strategy is a liquidity management approach used in decentralized finance (DeFi) protocols. It aims to maintain a balanced liquidity position by periodically adjusting the position location based on market movements. This strategy's fixed width helps consistently manage risk and maintain stability in a trading portfolio over time.

Ideal Applications

If there is no garuntee of counter liquidity in the pools, it is best to implement multiple pools at various widths for counterplay.

Complex Description and Uses

Strategy Details

The Classic Rebalance Strategy operates by:

- Setting a position size measured as a percentage, multiplier, or in ticks (smallest price increments)

- Using the current pool tick as the center point

- Regularly checking if the pool tick has moved outside a specified range

- Rebalancing the position if necessary by buying or selling assets

Key Features

- Flexible width configuration

- Customizable rebalancing triggers

- Adaptive liquidity distribution curves

- Single-sided liquidity provision options

This strategy has rebalance trigger support and liquidity curve support.

Strategic Advantages

- Tailored risk management

- Market-responsive positioning

- Enhanced liquidity efficiency

- Versatility across asset types

Technical Explanation

The Classic Rebalance Strategy is part of the Dynamic Rebalance Strategy suite in the Steer Protocol. It offers high customizability and adaptability for liquidity provisioning across various asset types and market conditions.

Core Mechanics

Position Sizing: There are three options for determining position size:

- Price Percentage: the position range is a given percentage above and below the current price. Best for values under 30% as the percentage change relative means the down draw will have a larger effect than intended. Best used for pools with volaitliy close

- Price Multiplier: the upper and lower bounds of the position are given by mulitiplying and dividing the current price by the provided multiplier respectively. This is prefered for very volatile asset pairs, or if you want to negate the percentage change effect (i.e. a multiplier of 1.3 will give a more accurate spread than the price percentage at 30%)

- Static Width: the position width is determined by the value provided here. This is measured in ticks, the smallest price increment. The pool tick spacing is important to factor in, as valid positions can only start and end on initializable ticks (multiples of the pool's tick spacing). This option is best for very narrow strategies or if an exact width is desired.

Rebalancing Check: On each execution interval, the strategy evaluates if the pool tick has moved outside the specified range from the original position or satisfied the configured trigger condition.

Rebalancing Action: If the pool tick has moved beyond the threshold, the position is adjusted by buying or selling assets to realign with the new pool tick. If the tick remains within range, no action is taken to minimize transaction costs.

Placement Modes: By default the position in created centered on the current price. However, additional options are available, expanding options for asset-specific management.

Liquidity Curves: The Steer curve library is available in this strategy, which will--when possible--create the configured liquidity curve inside the position range.

Implementation Considerations

- Frequent rebalancing can incur higher transaction costs or gas fees.

- The strategy's effectiveness depends on proper configuration of width settings, rebalancing triggers, and liquidity distribution curves.

- LPs should carefully consider market conditions, asset volatility, and their risk profile when implementing this strategy.

By offering this level of customization, the Classic Rebalance Strategy enables LPs to create bespoke liquidity provision approaches that can adapt to a wide array of market conditions and strategic objectives.