Static Stable Strategy (Optimized Pegged Strategy)

Basic Overview

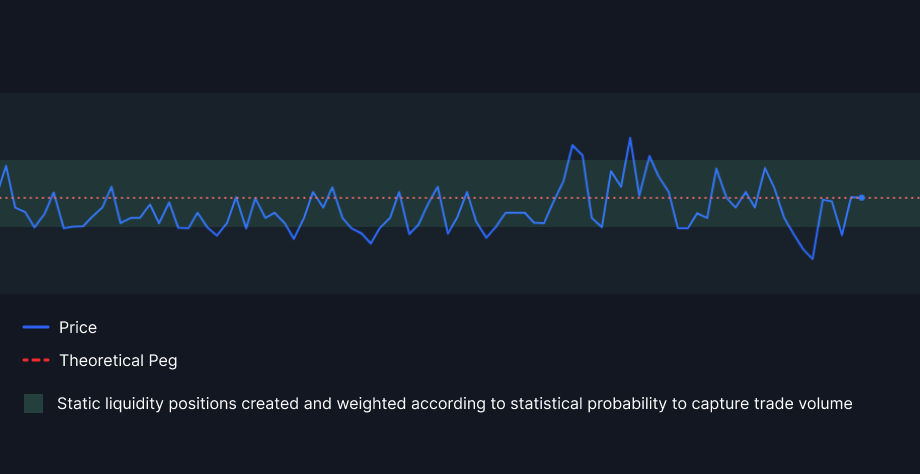

The Static Stable Strategy, also known as the Optimized Pegged Strategy, is a cutting-edge solution tailored for stablecoin pairs and assets with pegged values. It uses a multi-position vault architecture to create an optimal liquidity configuration around the pegged price of the asset pair, specifically designed for implementation on CLAMM pools. A unique circumstance with these strategies is the listed APR will approximately be the true return on funds invested in such strategies.

Ideal Applications

In some cases it may be appropriate to use this strategy on LST and LRT pairings.

Complex Description and Uses

Strategy Details

The Static Stable Strategy operates by:

- Employing statistical optimization to dynamically tailor liquidity allocations

- Focusing liquidity near the asset pair's pegged price

- Can emulate the liquidity curve of other popular Automated Market Maker (AMM) mechanisms

- Allowing users to configure the center tick (peg) and space width for the position channel

- Calculating a theoretical tick based on token decimal precisions

Key Features

- Statistical Optimization

- Pegged Price Alignment

- Configurable Center Tick and Space Width

- Theoretical Tick Calculation

Strategic Advantages

- Mitigated Impermanent Loss

- Augmented Liquidity Depth

- Enhanced Market Efficiency

- Improved Price Stability

- Maximized Trading Fee Earnings

Technical Explanation

The Static Stable Strategy uses a sophisticated, data-driven approach to optimize liquidity provision for pegged asset pairs.

Core Strategy Mechanics

Theoretical Tick Calculation:

- Calculate the theoretical tick for a stable pair based on token decimal precisions or where the market peg is

- This theoretical tick represents the mid-price of the pair

- Used as a reference point for liquidity position placement

Position Weighting:

- Positions are typically weighted to form a standard normalized curve

- Spreads liquidity across the tick range to form desired liquidty shape

- Ensures positions aren't concentrated in a single area, maximizing trading opportunities

Multi-Position Vault Architecture:

- Deploys multiple liquidity positions around the pegged price

- Allows for fine-tuned control over liquidity distribution

Statistical Optimization:

- Range can by determined by data-driven approach for optimal liquidity allocation

- Aims to enhance market participation efficiency

- Works to place competitive liquidity while supporting volatility relative for the asset pair

Configuration Parameters

Center Tick:

- Users select the center tick or peg of the two asset's prices

- This determines the focal point for liquidity provision

Number of Tick Spaces:

- Users define how many tick space widths should make up the full position channel

- Any applied curves will be created within this range

Implementation Considerations

- The strategy is static; offset and variance cannot be changed after configuration

- Regular monitoring of pool dynamics may be necessary for optimal performance

- The space width should be carefully chosen based on the historical volatility of the asset pair

- While designed to essentially negate IL, risk of a stable asset losing it's backing is always a risk that LPs should be aware of

- Future versions may allow for more dynamic liquidity provision strategies

Alternatives: Elastic Stable Strategy

The Elastic Stable Strategy is an alternative approach for stablecoin and pegged asset pairs with different mechanics. This strategy aspires to provide liquidity at a guaranteed width from the peg or center tick. There are no curve mechanics included, but the strategy will expand to include wherever the current tick is on the pool and the specified buffer (width on one side). This comes with the benefit of staying in range on "volatile" stables where the price moves out of a typical range frequently, but comes with the downsides of reblancing costs and pushing the price more off peg if one sided.

Conclusion

By offering this level of optimization and customization for pegged asset pairs, the Static Stable Strategy enables liquidity providers to create efficient, low-risk positions that can effectively maintain price stability, enhance market depth, and generate returns through trading fees in stablecoin and pegged asset markets.