High Low Channel Strategy (Donchian Channel)

Basic Overview

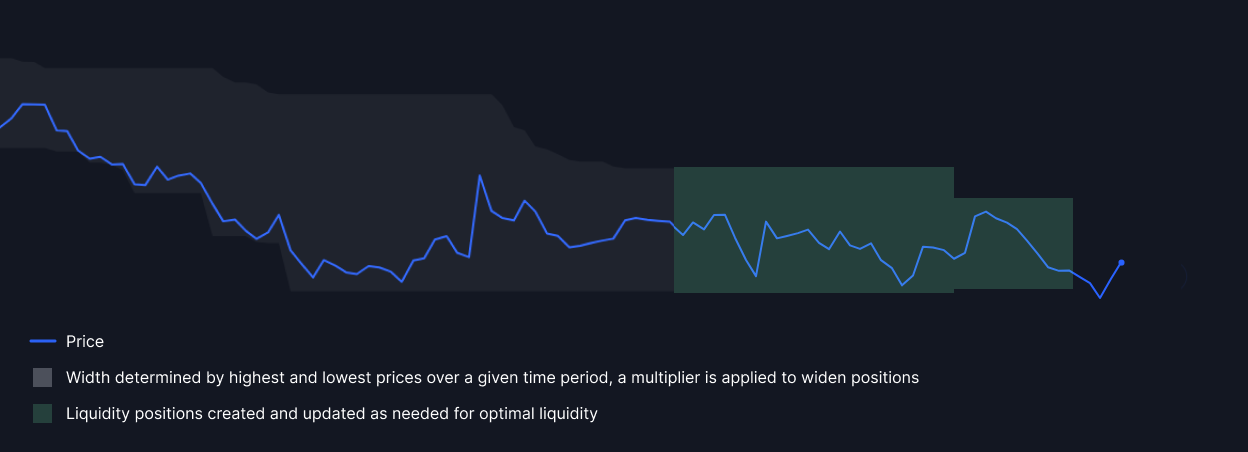

The High Low Channel Strategy, also known as the Donchian Channel Strategy, is an advanced market making solution used in decentralized finance (DeFi) protocols. It utilizes the concept of Donchian channels to gauge market dynamics effectively. This strategy monitors the highest price and the lowest price over a selected period through candles, offering a strategic view of market trends and volatility to guide liquidity provision.

Ideal Applications

This strategy requires candle data to operate, ensure there is a reliable data source for the candles for proper execution.

Complex Description and Uses

Strategy Details

The High Low Channel Strategy operates by:

- Establishing a channel based on the highest high and lowest low prices within a specified timeframe

- Optionally applying a multiplier to adjust the channel width

- Using this channel to guide liquidity provision decisions

- Adapting to market volatility by dynamically adjusting the channel width

Key Features

- Donchian Channel basis

- Flexible multiplier option

- Market adaptability

- Enhanced market sensitivity

- Customizable volatility management

This strategy has rebalance trigger support and liquidity curve support.

Strategic Advantages

- Responsive to market movements

- Tailored approach to liquidity provision

- Effective in diverse market conditions

- Risk mitigation in volatile markets

- Potential for optimized returns in both medium and wide market conditions

Technical Explanation

The High Low Channel Strategy leverages the Donchian Channel concept to provide a robust framework for liquidity provision across various trading environments.

Core Mechanics

Channel Calculation: The Donchian Channel is calculated using the following formulas:

Upper Donchian Channel Bound = Highest High over N periods Lower Donchian Channel Bound = Lowest Low over N periods

Where N is the number of periods used to calculate the Donchian Channel. Functionally the size or "thickness" of the candles provided do not matter since the highest and lowest prices will still manifest in the OHLC data. The length of the interval will typically correlate to how wide the strategy will be.

Multiplier Application: An optional multiplier can be applied to extend the channel width, allowing for adjustment based on observed market conditions and historical data depth. This keeps the channel centered in the same location but the width multiplied.

Liquidity Provision: The strategy uses the channel boundaries to guide liquidity provision decisions. Typically, a breakout above the upper boundary signals a long position, while a breakout below the lower boundary signals a short position.

Dynamic Adjustment: The channel width is dynamically adjusted based on market volatility for a given interval, ensuring the strategy remains relevant across various trading environments.

Implementation Considerations

- The choice of the number of periods (N) for calculating the Donchian Channel can significantly impact the strategy's performance. Typically this strategy is better suited for medium to wide positioning and managing divergent loss risk.

- The multiplier should be carefully chosen based on market analysis and risk tolerance, along with how long of an interval will be used.

- Like all trading strategies, the High Low Channel Strategy comes with its own risks and potential downsides. Thorough testing is advisable before implementation in a live trading environment.

- The strategy's effectiveness may vary depending on market conditions and the specific assets being traded.

By offering this level of market sensitivity and adaptability, the High Low Channel Strategy enables LPs to create sophisticated liquidity provision approaches that can effectively respond to various market trends and volatility levels.